Ad International Expat Health Insurance for you and your family. - Free Quote - Fast Secure - 5 Star Service - Top Providers.

Affordable Supplemental Pregnancy Insurance My Family Life Insurance

Affordable Supplemental Pregnancy Insurance My Family Life Insurance

Childbirth in a hospital without health insurance.

Baby health insurance cost. Ad International Expat Health Insurance for you and your family. While estimated costs can be helpful in preparing for a newborn its important to understand that insurance coverage location of residence and the overall health of the baby are all significant factors. While maternity expenses for insured moms might seem high the numbers are far higher if you have no insurance at all.

Vaginal birth 901388 1977579. Every child is different and it may take a few months for you to determine how often they will need to see their doctor. C-section birth 740407 1492776.

Ad Compare Top Expat Health Insurance In Indonesia. But here are some ballpark figures. Some states charge a monthly premium for CHIP coverage.

Get the Best Quote and Save 30 Today. Get the Best Quote and Save 30 Today. Birth by whichever means comes at a cost.

While youre preparing for your baby to arrive review the costs and benefits of your current health insurance and compare them to other plans and options. Baby health insurance cost average in Northern California is around 391 the Central Valley area average is 317 and Southern California average is 338 per month. Routine well child doctor and dental visits are free under CHIP.

Typically the average cost of delivering a baby is about 11000 15000 for a C-section. According to a 2016 study from the Health Cost Institute health care expenditures for babies amounted to an average of 4879 each year. How much youll pay will depend on factors like where you live whether you have any complications and whether you have a vaginal birth or a c-section.

First you can purchase an individual health plan and only include your baby in the coverage. Ad Deutsche Versicherung - health liability and accident insurance. Your baby also may be eligible for free or low-cost coverage if you fall below specific income limits.

These survey results considered many factors including hospital and facility charges and costs quality of medical services received and availability of local services. - Free Quote - Fast Secure - 5 Star Service - Top Providers. There are a few options to consider regarding health insurance for your baby.

Ad Compare Top Expat Health Insurance In Indonesia. This is because young single men are the lowest-risk group when it comes to health insurance. But there may be copayments for other services.

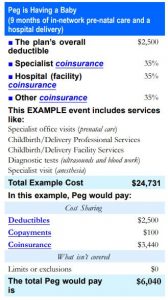

Childbirth in a hospital with health insurance. Health insurance rates are based on many variables but the average cost of health insurance for a single person is roughly 3000 per year. This coverage is provided through Medicaid and the Childrens Health Insurance Program CHIP.

- Fast Secure - Free Callback - Customizable Health plans - Worldwide Cover. Those prices have increased dramatically in the last decade. C-section birth 1259360 28491.

- Fast Secure - Free Callback - Customizable Health plans - Worldwide Cover. The Truven Report put the uninsured cost of having a baby at anywhere from 30000 for an uncomplicated vaginal birth to 50000 for a C-section. If were looking at the average costs for individual health insurance a young single male could pay premiums as low as 100 or as high as 300 depending on the level of coverage he wants.

Vaginal birth 488444 1068128. 54 rows Monthly premiums for ACA Marketplace plans vary by state and can be reduced by. Ad Deutsche Versicherung - health liability and accident insurance.

As a result the estimated average cost of having a baby for women with health insurance through their employer rose to 4569 in 2015 up from 3069 in 2008 according to a report in the journal. The costs are different in each state but you wont have to pay more than 5 of. Prenatal care and delivery costs can range from about 9000 to over 250000 quite a range huh.