Enterprise Risk Management Framework 2020 Effective risk management supports the University to achieve our strategic and operational objectives. Enhance Premium Brand.

Basics Of Enterprise Risk Management Erm How To Get Started Process Street Checklist Workflow And Sop Software

Basics Of Enterprise Risk Management Erm How To Get Started Process Street Checklist Workflow And Sop Software

Enterprise Risk Management Framework 3 How We Define Categorize Risk Risk management requires a broad understanding of internal and external factors that can impact achievement of strategic and business objectives.

Enterprise risk management framework. Enterprise Risk Management Framework Risk is the chance of something going wrong. Engaged by COSO to lead the study PricewaterhouseCoopers was. The Enterprise Risk Management Framework ERMF PDF 151KB is a comprehensive approach to identifying assessing and treating risk based on the departments risk.

Enterprise Risk Management Integrated Framework. Enterprise Risk Management Framework integrates the processes for managing risks and control into Councils governance strategy and planning performance improvement reporting process policies values and culture and it considers the internal and external context in which Council operates. SimpleRisk a comprehensive easy to use affordable risk management platform.

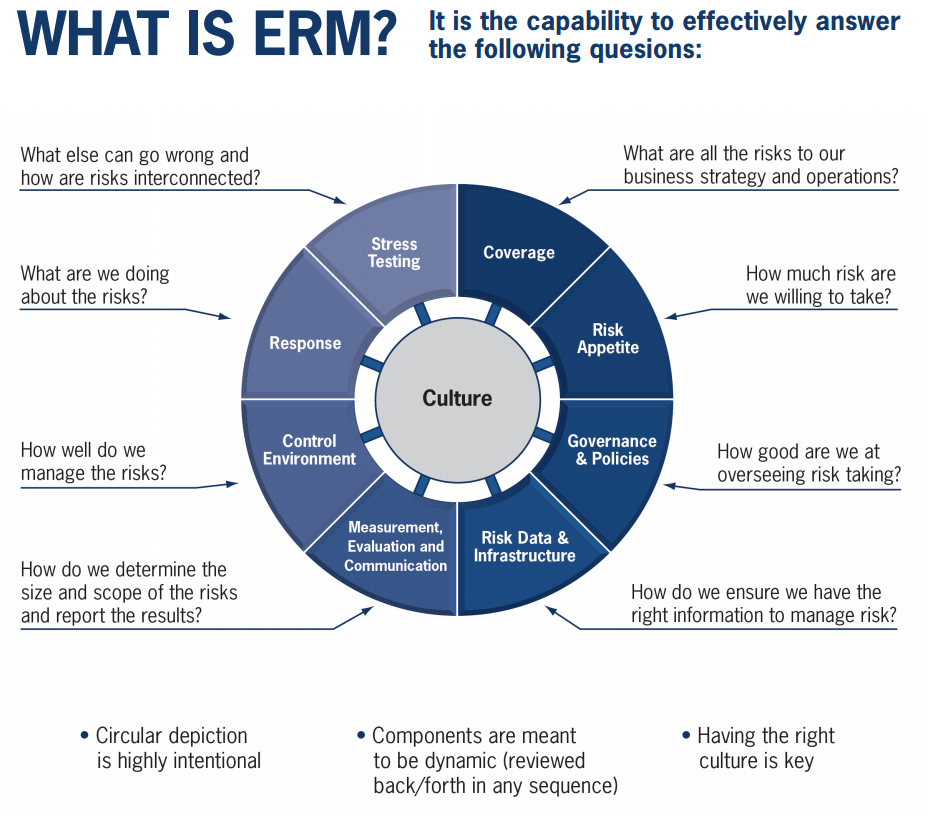

Ad Risk management solution to identify analyze prioritize and respond to risks. The original COSO Enterprise Risk Management Framework is a widely accepted framework used by boards and management to enhance an organizations ability to manage uncertainty consider how much risk to accept and improve understanding of opportunities as it strives to increase and preservestakeholder value. Enterprise Risk Management Framework 6 ERM involves a proactive holistic enterprise- wide- view of all risks and their associated risk appetite and tolerances to ensure that they are fully aligned with the credit unions objectives and strategies and reflects the quality competencies and capacity of people technology and capital.

Drive a culture where everyone takes responsibility. Enterprise Risk ManagementIntegrating with Strategy and Performance 2017 In keeping with its overall mission the COSO Board commissioned and published in 2004 the Enterprise Risk ManagementIntegrated Framework. The Framework defines essential enterprise risk management components discusses key ERM principles and concepts suggests a common ERM language and provides clear direction and guidance for enterprise risk management.

Historically risks to the Companys success have been categorized as Strategic Operational Compliance and Financial Reporting. It is an essential part of good governance and helps to. Enterprise risk management is a procedure designed to categorize impending events that may distress the entity and minimize the risk and constrain it to entitys risk appetite to proffer rational assertion regarding the accomplishment of entity goals and objectives.

Enterprise risk management ERM is a plan-based business strategy that aims to identify assess and prepare for any dangers hazards and other potentials for disasterboth physical and. Enterprise Wide Risk Management Framework March 2017 Regulatory Compliance Enterprise Wide Risk Management Framework 1 Risk Governance Committee Structure and Authority Board and Board Risk Committee Mandate delegated authorities 2 Risk Oversight and Control Function. SimpleRisk a comprehensive easy to use affordable risk management platform.

Ad Risk management solution to identify analyze prioritize and respond to risks. Over the past decade that publication has gained broad acceptance by organizations in their efforts to manage risk. The enterprise risk management framework starts with the understanding of the business objectives in ensuring that key risks are identified.