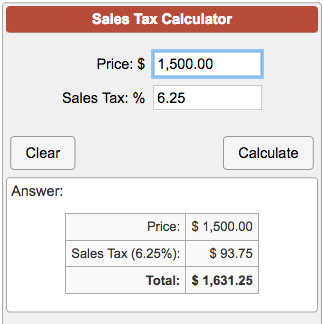

Use this calculator the find the amount paid on sales tax on an item and the total amount of the purchase. Then you multiply that number by the sales tax.

Tax Avoidance Over Time A Comparison Of European And U S Firms Sciencedirect

Tax Avoidance Over Time A Comparison Of European And U S Firms Sciencedirect

1 You buy a item on Ebay for 999 dollars and pay 75 percent in tax.

What is 9.99 plus tax. In order to calculate sales tax you have to know what it is where you live. We used the following formula. Sales Tax Calculator.

Do you want to know how we calculated 5199 plus tax. Further budget 2018 also introduced the concept of standard deduction of INR 40000 which has been again increased in budget 2019 to Rs 50000. January 1 2012 to December 31.

225 city plus 7 state. In Memphis I assume the sales tax rate is. Income Tax Act provides various exemptions from salary like house rent allowance leave travel allowance etc.

Sales tax Formula Final Price. 75100 0075 tax rate as a decimal. We used the following formula.

So take this formula 1925 total sales tax X article price. For EarthBound on the Super Nintendo a GameFAQs message board topic titled For the VC version is it 999 plus tax or if i put 10. For example the jeans orange soda and Blu-ray DVD are taxable.

Do you want to know how we calculated 999 plus tax. Now find the tax value by multiplying tax rate by the before tax price. This means that depending on your location within California the total tax you pay can be significantly higher than the 6 state sales tax.

T A A i100 In the formula above i is the tax rate A is 5199 and T is the answer. With the help of this calculator based on the data from Canada Revenue Agency and Revenu Québec for 2012 2013 you can calculate the sales tax for any amount in each province and then compare the result in the chart with the other provinces. Firstly divide the tax rate by 100.

999 X 06 6. Ad Search Faster Better Smarter Here. Depends on the tax rate.

Type of supply - learn about what supplies are taxable or not. Before 2013 the QST tax was calculated on the selling price plus GST. The province of Quebec has changed the way of calculating its sales tax.

Ad Search Faster Better Smarter Here. Why have I been recieving a charge of 999 plus tax for montha now. What is 999 plus tax which is 9.

The Quebec Sales Tax increases to 9975 of the selling price to maintain the same level of taxation. The sales tax added to the original purchase price produces the total cost of the purchase. 10925 X 1998 2183 rounded up and 2182 rounded down.

0 Recommended Answers 0 Replies 0 Upvotes. The rate you will charge depends on different factors see. The provincial tax was applied on the amount including the GST which explains the total tax being higher than just the simple addition of the two taxes.

Tax 9999 0075 tax 75 tax value rouded to 2 decimals Add tax to the before tax price to get the final price. Have you ever bought something at a store with a price tag that read 999 but you actually ended up paying more than 999. Sales tax is calculated by multiplying the purchase price by the sales tax rate to get the amount of sales tax due.

Been recieving for some rine now and thought it would go away. Then add the sales tax to your purchase. It is now calculated on the selling price only not including GST.

What is this charge for. The following table provides the GST or HST provincial rates since July 1 2010. Many items you purchase may require that you pay sales tax.

Then 5999 plus 5tax 5999 5999x005 6299. This tax exemption will not be available in case you are opting for the new tax regime. The final price including tax 9999 75 10749.

Purchase and Payments Android Discuss with others. Who the supply is made to - to learn about who may not pay the GSTHST. T A A i100 In the formula above i is the tax rate A is 999 and T is the answer.

California has a 6 statewide sales tax rate but also has 511 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 2445 on top of the state tax. What is the tax on it and what is the total price including tax. Where the supply is made - learn about the place of supply rules.

If the tax is 12 then 5999 plus 12tax 5999 5999x12 6719 What is 20 subtracted by 1524 plus tax. The difference is the sales tax that the seller is required to charge and then pay to the state.

Us Corporate Income Tax Now More Competitive Tax Foundation

Us Corporate Income Tax Now More Competitive Tax Foundation

Https Staff Blog Ui Ac Id Martani Files 2018 09 P5 Home Country Tax System Pdf

Tip Sales Tax Calculator Salecalc Com

Tip Sales Tax Calculator Salecalc Com

Pdf Tax Ratios A Critical Survey

Pdf Tax Ratios A Critical Survey

Never Pay Taxes On Playstation Ever Again 2017 And 2018 Still Working Youtube

Never Pay Taxes On Playstation Ever Again 2017 And 2018 Still Working Youtube

H R Block Diy Tax Prep Solutions Provide Unparalleled Value H R Block

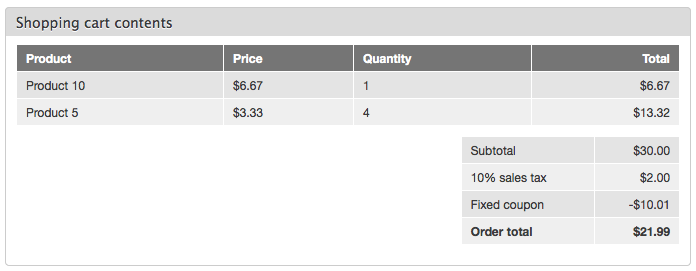

Setting Up Taxes In Woocommerce Woocommerce Docs

Setting Up Taxes In Woocommerce Woocommerce Docs

Setting Up Taxes In Woocommerce Woocommerce Docs

Setting Up Taxes In Woocommerce Woocommerce Docs

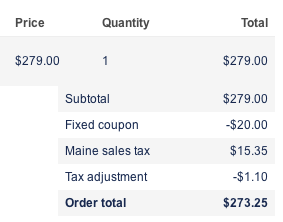

Calculate Fixed Amount Before Tax Calculation 1612662 Drupal Org

Calculate Fixed Amount Before Tax Calculation 1612662 Drupal Org

Calculate Fixed Amount Before Tax Calculation 1612662 Drupal Org

Calculate Fixed Amount Before Tax Calculation 1612662 Drupal Org

Setting Up Taxes In Woocommerce Woocommerce Docs

Setting Up Taxes In Woocommerce Woocommerce Docs

Corporate Tax In The United States Wikipedia

Corporate Tax In The United States Wikipedia

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.